Will Christmas turn into Hannukah?

September 19, 2015

Lately the market has been all over the place. If you’ve been paying attention to your portfolio, it might have seemed as though Christmas (yes, Christmas) was coming around earlier than usual with all the green and red. So the question is why? And what?

Over the past year, large and enthusiastic investors inflated the Chinese stock market by purchasing large shares of stock on margin — that is, by taking out a loan proportional to the amount of money in their accounts in order to purchase more stock. When margin calls were issued — when lenders required the account holders to bring the margin back in line with the value of their accounts — many investors with large stakes were forced to sell off, which is why the market sank.

Many had argued that the Dow Jones Industrial Average was in need of a correction; the instability in China happened to be the trigger.

Another factor in the situation was the prospect of continuing falling global demand for oil, which led oil prices straight down the toilet. The price of a barrel of West Texas Intermediate crude dropped below $40 for the first time since 2009.

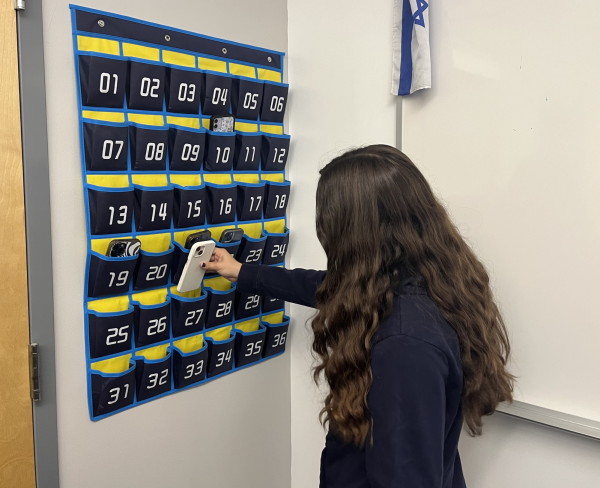

Oil and energy concerns likewise have affected the stock exchange of Israel. Amidst these troubles, Tel Aviv’s TLV 25 index has fallen off roughly 7.5 percent in the past month — only slightly less than the Dow. This tumble occurred both as a result of worldwide economic panic and political instability in the Mediterranean.

Israel’s $148-billion dollar stock market took a particular hit Aug.31, after it was reported that Egypt had found possibly the biggest oil reserve in the Mediterranean. This brought plans for Israel to export gas to Egypt into question, while also bringing down shares of Israel’s own Delek Group Ltd., which experienced a loss of over 12 percent in just two days.

What does it all mean? There is a clear buying opportunity here. As stocks and oil prices are dropping, great entry points are presented. I myself have already purchased shares of BP, and I remain bullish. BP maintains a six- to seven-percent yield, and the company has reiterated that maintaining its dividend is the number one priority.

The immediate future for China doesn’t look bright. Nor does the future for the American stock exchanges. But don’t panic through the turbulence, and hopefully by the time Hannukkah comes around we’ll get the gift of a market turnaround.

Stock Talk: Futuristic Israeli company promotes safety now

The award for biggest IPO for an Israeli startup goes to Mobileye N.V. a collision avoidance system working closely with the world’s largest car manufacturers to ensure safety for their drivers.

Shares of this Jerusalem-based tech startup have been soaring ever since its IPO Aug. 1, when the company offered nearly 35.6 million shares at $25 each, a significantly larger start than most IPO’s in 2014. Since then the stock has more than doubled, trading at $46.98 as of Nov. 17.

As prospective investors, we must ask ourselves what the driving forces are in Mobileye’s gains and whether they merit our financial attention – and not only from a pro-Israel perspective.

Mobileye manufactures and sells anti-collision hardware, which can monitor various dangers while driving such as excessive speed, unseen pedestrians and cyclists and unintended lane departure. Aside from selling individual units, Mobileye has established a close relationship with many large car manufacturers, including Ford, GM, BMW and Volvo. Mobileye installs its devices into newly manufactured cars, allowing the features to be part of each car and not a post-sale add-on.

Meanwhile, Mobileye is also working with Tesla — the all-electric luxury car manufacturer — reportedly to further Tesla’s goal of creating a self-driving car. According to its IPO filing, Mobileye believes its technology will help allow hands-free driving on the highway by 2016.

Just last month, Tesla unveiled a new version of its previously popular car, the Model S. Named the Tesla P85D, it contains new, built-in in features that heavily rely on Mobileye’s technology and exceed simple collision avoidance alerts.

For example, the car is able to read signs and adjust the speed of the car to the sign. It will also slow down automatically if you get too close to the car in front of you, and will make its own lane changes once you indicates which lane to turn into, using the turn signal.

Shareholders were not too ecstatic about the car’s price — $105,670 — and both Tesla, and Mobileye shares took a hit. Mobileye shares dropped 18 percent, leaving the price in the low $40s, though it has since rebounded. Tesla shares dropped 13 percent, leaving the price fluctuating around $225.

But I believe that in the future, Tesla will use Mobileye’s technology in all of its future models, including those that come out at a cheaper price. Mobileye is a long-term investment in the future of car technology and I believe that investing in it will without a doubt increase the long-term value of your portfolio.

I’ve said in this column before, stocks can represent more than just what you believe will make you money. If I haven’t convinced you that Mobileye is a good stock to have in your portfolio by now, I would still suggest supporting them by keeping yourself safe and purchasing their software. It’s good for you and for car riders everywhere and good for Israel, too.

Hopefully the BDS movement won’t take too much notice to this rising star.

Stock Talk: Sell Rosh, buy Yom?

As I was rummaging through my mind to think of something to write about to start the school year, I wondered whether there could be any direct ties between Wall Street and Jewish life and traditions. My attention turned to the High Holidays and, really not thinking I would find anything, I typed five words into my browser:

“Stock picks for Rosh Hashanah.”

To my surprise, two out of the three top articles that appeared tied Rosh Hashanah to investing. What did I learn? There is a phrase thrown around here and there as the High Holidays come around on Wall Street: “Sell Rosh, buy Yom.”

And in fact, those might be the very words that investors think about when the S&P is dropping during the Yamim Noraim, or 10 Days of Awe, spanning from Rosh Hashanah to Yom Kippur.

It turns out that one Art Cashin, director of floor operations at the global financial services company UBS, wrote an article about this at High Holiday season in 2012. This article has been quoted dozens of times all over the internet.

“The way I learned it,” Mr. Cashin stated in his column for the online newsletter UBS Wealth Management, “you sell on Rosh Hashanah and buy back on Yom Kippur. The thesis, I was told, was that you wished to be free as much as possible of the distraction of worldly goods during a period of reflection and self-appraisal.”

So is this just a tradition that resides on Wall Street, or is it a legitimately smart move for one’s portfolio?

According to research done by Bespoke Investment Group and quoted in Mr. Cashin’s column, there is legitimacy to this position. From 2000 to 2012, the S&P 500 has averaged a negative 1.43 percent return during the span of the 10 days from Rosh Hashanah to Yom Kippur.

Specifically, for example in 2005, the S&P declined 4.06 percent. During the financial meltdown in 2008, following this tradition could have saved you from the 17.76 percent loss that the S&P experienced during these days.

While I’d like to think that these losses occurred because we Jews control the money supply and we really are buying less during a period of reflection, the facts are that Rosh Hashanah and Yom Kippur tend to fall in the month of September, which historically doesn’t perform well for the markets. Since 1950 the S&P has declined an average of 0.7 percent during the month of September, and customarily springs higher during the months of December and January.

My advice to you is not to necessarily participate in this trend, but perhaps to refrain from monitoring the markets so closely during the 10 days – to be, as Mr. Cashin said, “free of the distraction of worldly goods.”

Wishing everyone a Shana Tovah and easy fast.

STOCKTALK UPDATE: Last June, this column noted that investors should invest in GMCR, otherwise known as Keurig, when it was priced at $112: “I believe GMCR will continue to grow and prosper because it spends time making money and cutting deals to propel itself along.”

On Aug. 22, GMCR announced that it had made a deal with Kraft to create Kraft branded coffees for its single-serving brewing machines. The sale went through and as of Sept. 3, GMCR was trading at $133.96, which is 10.94 percent higher than when this column announced GMCR as a buy.

Stock Talk: Can Keurig topple Sodastream–and should you help?

Formerly known as Green Mountain Coffee Roasters and Keurig, the company Listed on the NASDAQ asGMCR has been pushing its way to the top of the coffee industry since the turn of the current century. I believe that Keurig will continue to grow as a company and will continue to be a high-yielding investment – however, Keurig is a major threat to a Shalhevet favorite, an innovative company named Soda Stream.

Full disclosure: Bo’s Barista Bar uses GMCR’s coffee machine. But I also support it because it has proven itself to be an established company with a bright future ahead.

Think about it. Several years ago you probably hadn’t heard of either Green Mountain Coffee Roasters or Keurig, but nowadays almost everyone has a single-serving coffee maker. Competitors such as Starbucks and Nespresso now also make single-serving machines and pods, but Keurig Green Mountain offers the greatest variety of coffees, teas and even hot cocoa.

As of May 6, Keurig was trading at a price of $95.27 per share. A company’s price-to-earnings (P/E) ratio can be a good measure of whether a company is overpriced or not, and for GMCR’s doesn’t look too good – 33.23 percent – suggesting that they seem to be priced at more then they are worth. But I believe GMCR will continue to grow and prosper because it spends time making money and cutting deals to propel itself along.

This year, for example, Keurig expanded its consumer base exponentially, entering a 10-year contract with Coca-Cola to produce cold carbonated beverages in-home as easily as a cup o’ Joe. The deal was announced on Feb. 4 after trading hours, and early Feb. 5 the share price skyrocketed over 35 percent, from $80 to $102 per share.

The partnership between Keurig and Coca-Cola also poses a threat to the Israeli home carbonation system Soda Stream, which in turn creates a moral dilemma for those of us that support Israel and Soda Stream. Soda Stream’s success has attracted Coca-Cola and Green Mountain to compete in the marketplace. Competition will be fierce, and since Coca-Cola has more resources it could potentially dominate the market.

Another variable that may play into Coca-Cola and Keurig dominating the market may be the many anti-Israel activists would rather support Coca-Cola and Keurig rather than Soda Stream. The BDS (Boycott, Divestment and Sanctions) movement against Israel is on the rise and could potentially harm Soda-Stream and deteriorate its share of the market which it created.

This raises a conflict of interest for those of us that care and support the state of Israel and its innovations. Since Soda-Stream was born and raised in Israel, employs Israelis and Palestinians, is owned and operated by a Jewish man by the name of Daniel Birnbaum, we naturally must ask ourselves whether it is more important to make a profit on GMCR, a huge competitor for Soda-Stream, or support the values of innovation and prosperity for the Jewish state by holding our cash at hand. These are things that cannot be handed to you by reading a finance column, but must be seriously considered by each and every individual.

Meanwhile Keurig also announced in early March that it would be expanding itsStarbucks line of K-Cups and revising its exclusivity agreement. This announcement rallied the stock upwards another 6 percent. Its most recent deal was with Peet’s coffee, in which it agreed to produce K-Cups of Peet’s coffee blends.

On the path that Keurig Green Mountain is taking right now, the earning in the future may reflect steady growth for the company and will ease the P/E ratio. I firmly believe that GMCR will continue to shoot up, and if you invest now you’ll at least have enough money to buy one of their machines.

I urge everyone who reads this to think of how his or her investments can represent their values. Are investments are just about making money, or more than just making money? For us at Shalhevet, there’s no starker way to view that question than when investment wisdom bumps up against our love of Israel. Happy Yom Haazmaut.

How to join the lucky 13 percent

I recently completed a Finance of Retirement and Pensions course online, and since then I have been thinking non-stop about whether I will retire comfortably – and whether you, my peers, will also. What is the best strategy for your retirement portfolio? Start as soon as possible, because the money you start saving now is only going to accumulate and yield more money in the future.

According to a study done by the Employee Benefit Research Institute, only 13 percent of workers are confident they will be able to retire “very comfortably.” Another 38 percent are somewhat confident and 21 percent are “not too confident.” Finally, 27 percent are not at all confident they will retire comfortably.

For high school students to be a part of that 13 percent is my goal.

It’s true as high school students we can’t put our money in a Roth IRA, Traditional IRA, or any other specified retirement account. Since we don’t work full-time, we also don’t qualify to start contributing toward Social Security yet, or know whether or not we will get a pension. But we can invest in mutual funds and long-term, dividend yielding stocks.

In fact, there are several options to explore at a young age when looking to save for retirement. The first thing you need in order to invest is money. If you have a source of income in any way, and are a high school student, I would recommend putting aside 10 to 20 percent of that money every year for your retirement.

As a kid you might think this is irritating and silly, but when you’re nearing retirement you will be happy that it’s a habit you’ve grown into.

Trying to pick out individual stocks that are winners can be very hard, and even professionals get it wrong 50 percent of the time. I therefore recommend investing your money in mutual funds such as those from Vanguard and Fidelity with a mixture between growth and value.

Buying into mutual funds reduces risk, because each fund is made up of many companies; that means you don’t lose so much if one or two fail. Growth funds are comprised of companies with high potential for growth, whereas value funds compile stocks that are usually more established and pay dividends.

You do need to pay attention to the annual fee that the mutual funds charge, and strive to find those with fees under 1 percent per annum. For example, if you invested $10,000 now in a mutual fund with a 7 percent return rate per year, with a fee of 2 percent (not ideal) you will have $141,935.60 after 40 years. With a lower fee rate of .05 percent (ideal) you would have $156,260.89 – a difference of more than $14,000. These numbers were calculated using an interactive spreadsheet from one of my class’s assignments.

Imagine, if you were contributing during each of those 40 years, how much more you would have with that lower fee rate. From high school until retirement is a long time, which is why your money will be worth a lot more.

Since you need to diversify the investments in your retirement portfolio, you can’t use only mutual funds, and should put in some individual stocks. The most commonly seen stocks in retirement portfolios are large-cap, dividend-yielding stocks. These are companies such as Apple, AT&T and ConocoPhillips, which have been around for a while, and have a history of increasing their dividend payout. It is essential to have these sorts of assets in your retirement portfolio because they pay out sums of cash for every share you own, which in the long term adds up.

But by far the most important thing is to start saving now and contribute to your retirement fund on a regular basis. Invest in low-fee mutual funds and some individual stocks, and that golf club membership will one day pay for itself! Following these steps when you’re young is essential to getting into the habit of saving for retirement.

We should all be able to say that we are very confident that we will retire comfortably. So why not start now?

Put your money where your thirst is: Investing in Starbucks

Ask Shalhevet students what keeps them running through a rigorous day of school, and there’s a high chance they’ll tell you that before second period they’ve already finished off their Venti Skinny Caramel Macchiato and a three-pack of madeleines from Starbucks. Buying Starbucks in a store might get you through the day, but buying its stock will give your portfolio just the boost of caffeine that it needs. And by caffeine, I mean money.

Starbucks (SBUX) is the single largest coffeehouse company in the world, with branches in 62 countries around the globe. Annual reports from Starbucks.com say there are currently about 18,000 fully operating locations, and last year they announced plans to open 3,000 new ones, just half of which would be in America. Interestingly enough, none of these stores will be in Israel, and as Shalhevet students, we can’t ignore this fact.

Actually, Starbucks used to have six stores in Israel, but they shut them down in April 2003 – during the second intifada – saying they’d experienced a loss in revenue and could not afford the operational costs. Partly because of the timing and the fact that Arab states had called for a boycott of Starbucks because of their Israeli stores, there are people who think that Starbucks is not such a great company for Jews to invest in. So I looked into it for myself.

The facts of the matter are these. Starbucks had six stores in Israel from 1998 to 2003. The company says that they pulled out because of operational costs as previously stated. The real question is why they aren’t expanding to Israel now, when they’re opening 3,000 new stores around the world. On its website, Starbucks makes a point of saying that the company does not support Israel in any way – apparently responding to frequently asked questions. But it also addresses why they left, by saying that it goes no further than that business was not going well. However, elsewhere on the website they do discuss the fact that they will continue to assess the feasibility of expanding to anywhere possible. Therefore, Israel is presumably an option, but not a prime location or priority for Starbucks.

Personally I think that Starbucks did close strictly because of operational costs, because the coffee market in Israel is already extremely saturated. When I lived in Israel in 5th grade, my mom would always go out to coffee with her friends at their local Israeli-owned café and sit and talk. Israelis, in my opinion, aren’t looking for the American Starbucks café experience. They already have something of their own going on, and they love it. Starbucks probably realized this also.

Three-thousand new stores is a lot anywhere in the world, and for some, it’s hard to look at this expansion as a good thing because of the effect on the company last time it expanded. Prior to 2008, Starbucks built too many locations too quickly. The new locations didn’t generate enough revenue to sustain the expansion, and the company actually ended up shutting down 600 locations worldwide—though some argue that this was primarily due to the economic recession that hit in early 2008.

Despite this, Starbucks’ current financial situation is looking hopeful. Starbucks is an extremely steady company to invest in for the simple fact that is a large-cap stock. This means that its market capitalization exceeds 10 billion shares; in this case, it’s 59 billion. Generally, the bigger market capitalization a company has, the more reliable it is as a steadily growing company.

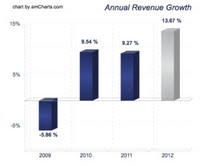

Since 2008, SBUX has been climbing itself out of a ditch, and has been successful in doing so. The remarkable growth in revenue is evident in the jump from the 5.86 percent decrease in 2009 to 13.67 percent in 2012 [see chart].

As of Nov. 7, the quote for one share of SBUX is $81.20. Since the start of 2013 (in stock talk, we say YTD, or year-to-date), Starbucks shares are trading around 49 percent higher, and it’s looking like this percentage will only increase. Another perk of holding SBUX is its 1.10 percent dividend yield, which will leave more cash in your pocket to buy your daily drink.

People around the world need their coffee just as much as Shalhevet students do. Starbucks is able to provide this service and rakes in a good profit from it. You should Invest in Starbucks not only because spending a dollar on your Caramel Macchiato is a dollar back into your pocket, but also because it does what a good company does to grow, by opening new stores and keeping its shareholders satisfied with its dividend yield.

Disclosure: I am long SBUX, which means that I own stock in the company and I’m hoping for it to go up. Other than owning shares of the company, I have no business relationship with the company. I wrote this article myself, and it expresses my own opinions, and I am not receiving any compensation for it.

NEW COLUMN – Stocktalk: When morals and money collide, it’s time to think things through

Personally I’m not a huge fan of the oil industry, but I am a huge fan of making money, and when it comes to a relatively steady source for it, I’m on it right away. So although I’ll be sharing my financial opinion in this column, there are certain circumstances when I must bring in my moral judgment as well. Deciding whether to invest in companies such as British Petroleum, Exxon, or Chevron is one of them.

The question in cases like this is whether it is ethical to invest in a company which has cruder values than those to which you hold yourself. BP is polluting the environment more and more every day, and is infamous for the oil spill that occurred back in 2010 that completely destroyed whole swathes of wildlife in the Gulf of Mexico. If you do decide to invest in this company, you must raise that question for yourself and decide whether the ends — making money — justify the means — endangering wildlife.

At Shalhevet one of the major ways that we learn is through moral development, with moral dilemmas presented in a wide variety of classes. Here is a moral dilemma that is not hypothetical, and here is how I considered it.

Along with the mass drilling and refining of oil that BP does, the company also does spend a large amount of money on investing in the future of alternative energy and what that could mean for America and the rest of the world. From 2005 through 2012, BP invested $7.6 billion into the research and development of alternative and renewable energy, bringing the company closer to its stated goal of investing $8 billion by 2015.

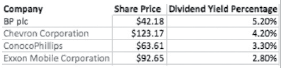

On a more financial note, most of BP’s competitors are also relatively high dividend yielding stocks so it’s easy to compare them to one another. Yield is a company’s  income return on an investment, commonly referred to in terms of a percentage.

income return on an investment, commonly referred to in terms of a percentage.

Above is a list of BP’s competitors’ yield percentages,

This shows that even though most of its counterparts have also experienced growth in their share price, BP is still the highest yielding dividend stock among the top oil companies.

Considering both those factors, in the end I decided that the ends do justify the means, especially because BP is making an effort to change, and so I bought some stock in the company. With the large amount of money that they’re pouring into alternative energy, it seemed to me to be a very close balance between the morals and the money.

Moreover, if I wanted to, there are many other ways I could protest against big oil companies and crude morals more effectively than boycotting their shares.

The decision I made considered the values of the company, my own values, and the potential for capital growth. Bringing morals into the equation made it a harder decision, but I decided the potential for capital growth was the most important thing under these circumstances.

Disclosure: I am “long” BP plc, which means that I own stock in the company and I’m hoping for it to go up in value. Other than owning shares of that company, I have no business relationship with any company whose stock is mentioned in this article. I wrote this article myself, and it expresses my own opinions, I am not receiving any compensation for it.

If you are interested in learning more about investing, consider joining the Finance Club, and visit the website www.wallstreetsurvivor.com to create an imaginary portfolio. Additionally, if there are any readers who work in the finance industry and would be willing to present what they do to the Finance Club, please e-mail [email protected]